Download Printable PDF

Download the PDF version for printing and sharing.

INTRODUCTION

The global airborne surveillance market is experiencing unprecedented growth. Increased terrorism, border protection issues, and geopolitical instability appear responsible for the increased demand. However, while these factors are a significant cause, several secondary issues add impetus.

Technology is advancing steadily, providing new solutions to the complex demands of global intelligence, surveillance, and reconnaissance (ISR). Simultaneously, established military alliances have adapted their strategies to cope with shifting allegiances, expanded surveillance areas, and tightened budgets.

These changes are moving end-users away from restrictive standalone proprietary surveillance platforms to expansive systems with collaborative software and hardware environments. Open, modular, and plugin architecture is becoming the future, offering a greater choice of mission applications, operating platforms, and sensor connections.

This paper will explore these issues and introduce commentary from industry experts on the state of the ISR market with an emphasis on airborne radar.

INTEROPERABILITY IS KEY TO MAKING ALL OF THESE DIFFERENT TECHNOLOGIES FIT INTO SITUATIONAL AWARENESS TOOLS, SO THE OPERATOR THAT IS ON THE LARGE PLANE WITH THE LARGE, POWERFUL LEGACY RADAR THAT CAN LOOK HUNDREDS OF MILES, CAN ALSO UNDERSTAND THE PICTURE THAT’S COMING FROM THE MORE WIDELY DISTRIBUTED AND SMALLER PLATFORMS THROUGHOUT THAT SPACE.– Stan Hargreaves, Head of Operational Capability Demonstrations, Leonardo

THE HISTORY OF AIRBORNE RADAR

Modern radars use AESA antennae and SAR and ISAR imaging to provide the required functionality and target resolution in any weather, through clouds, and without requiring light. Understanding the evolution of radar technology since World War II helps to understand the terminology, capabilities, and potential.

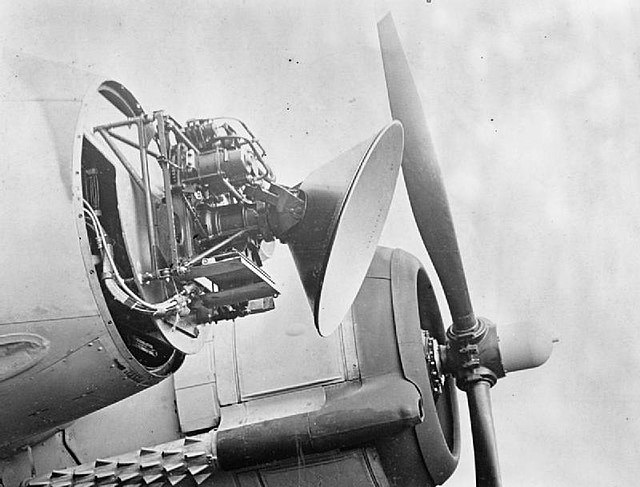

Passive Phased Array Antenna Development

Airborne radar in World War II comprised a single antenna rotating within a radome. Yet it was inefficient due to its size, rotation, and signal losses as they traveled from the transmitter to the antenna and back to a receiver. The first passive-phased array antenna not requiring rotation appeared in the late 1950s. The passive electronically scanned array (PESA) radar system comprised a bank of antenna modules with a computer to steer the radar beam electronically. This advance removed the need for antenna rotation, yet signal losses still occurred, and the system could only emit a single radar beam of a chosen frequency. With miniaturization, PESA radars became available for airborne use in the late 1960s.

Active Electronically Scanned Array (AESA)

The advent of the AESA radar solved the PESA radar system signal losses by giving each antenna module a solid-state transmit and receive unit connected to the central computer, making the system smaller and lighter. It allowed the transmission of multiple radio waves at multiple frequencies in different directions to provide greater information over a longer range while detecting smaller targets. These benefits permit the radar to perform simultaneous tasks such as conducting maritime surveillance and weather monitoring. The multiple frequencies make the system more resistant to radar jamming.

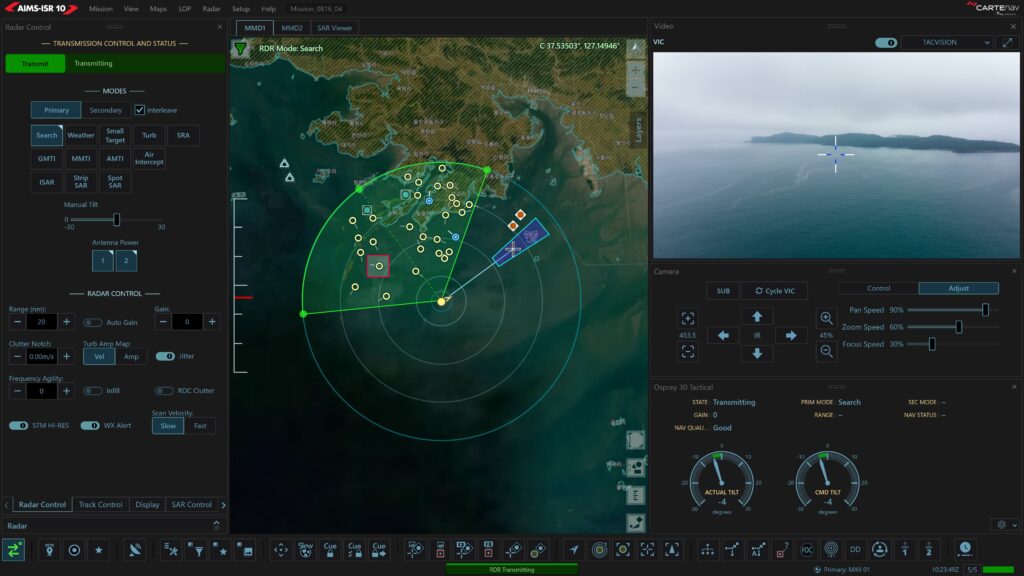

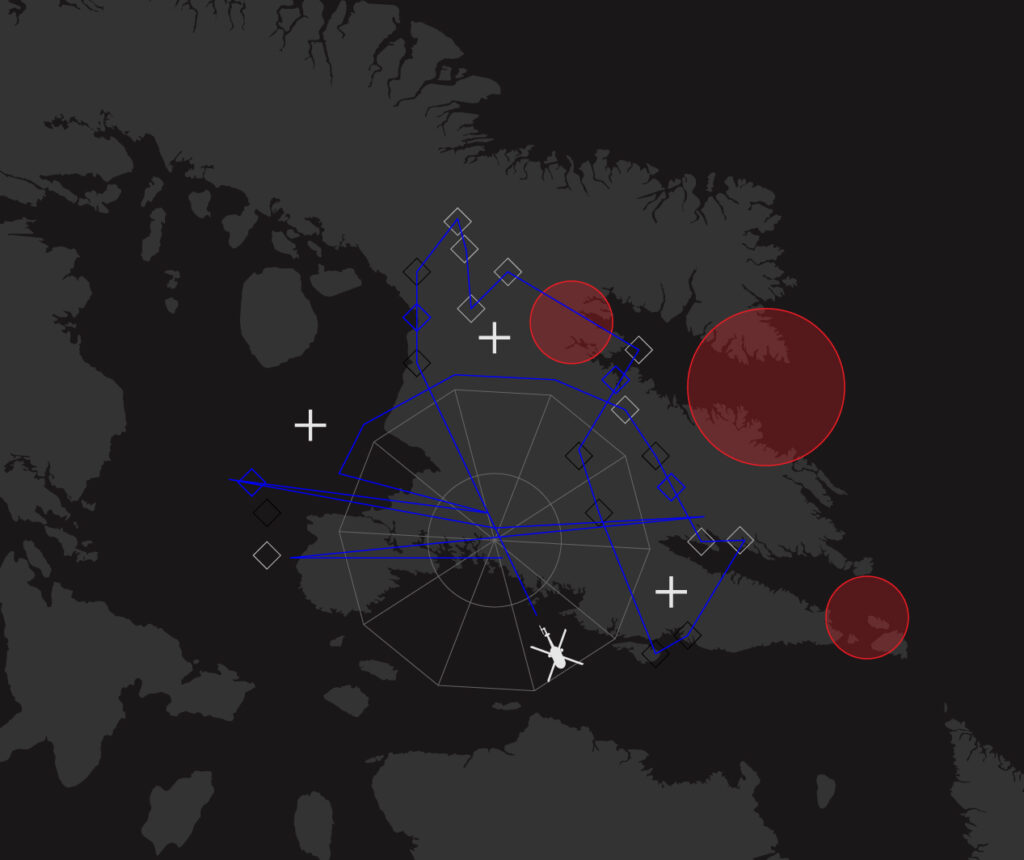

Leonardo’s Osprey 30 is an example of a second-generation active electronically scanned array (AESA) multi-mode surveillance. The Osprey 30 provides SAR and ISAR capabilities, maritime surveillance modes, moving target indication (MTI), and air-to-air surveillance. It allows two simultaneous search-mode operations while supporting a track-while-scan function of up to 1,000 automatically identified tracks. When Osprey 30 is paired with CarteNav’s AIMS-ISR multi-sensor mission system software, its output is aggregated with other sensors and overlaid onto 2D or 3D terrain data using a mapping system, providing operators with unparalleled situational awareness.

Synthetic Aperture Radar (SAR)

Phased array antennae and increasing computer power solved an important issue related to airborne radar resolution. Spatial resolution refers to the smallest discernible detail in an image1, and the spatial resolution provided by an antenna is linked directly to its size or aperture. You need a larger antenna if you need more detail at longer ranges. An airborne platform’s obvious constraints on antenna size limited the spatial resolution possible from airborne radar imagery.

Synthetic aperture radar uses the airborne platform’s movement to enlarge the antenna size artificially. By storing a series of radar returns, the line of sight to a target for each return changes slightly as the airborne platform moves at a known speed. Signal processing uses this difference to reconstruct a signal with a higher resolution equal to that produced by a much larger antenna.

Inverse Synthetic Aperture Radar (ISAR)

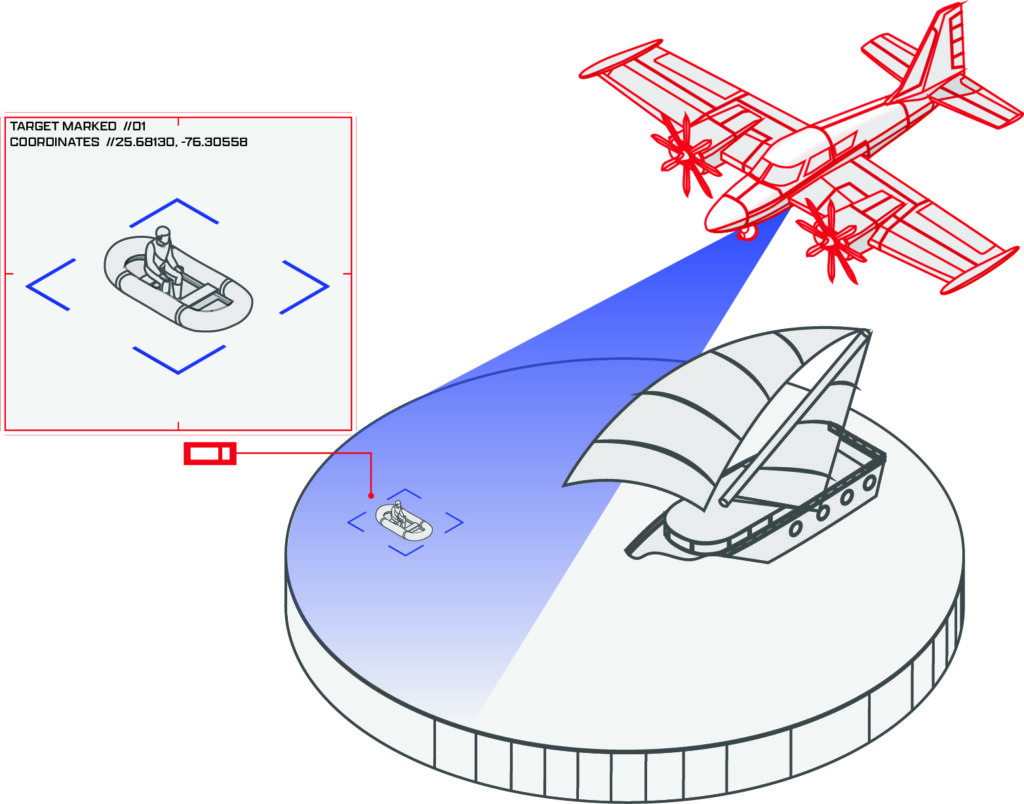

Inverse synthetic aperture radar is similar to SAR, except it uses the target’s movement rather than the platform to create a larger synthetic aperture and gain a higher image resolution. The primary use of ISAR technology is in airborne maritime surveillance, where wave action and the target’s motion produce sufficient movement to produce an image resolution adequate for target recognition.

MARKET DRIVERS

The intersection of emerging technologies and increased global cooperative security needs are important drivers for airborne radar use.

Military Alliances

European and North American countries established NATO in 1949 to provide collective self-defense for its North Atlantic signatories and to gather and share information and intelligence to maintain situational awareness. Alliance members individually and collectively invest in ISR capabilities to meet these expectations.

System Flexibility and Interoperability Imperatives

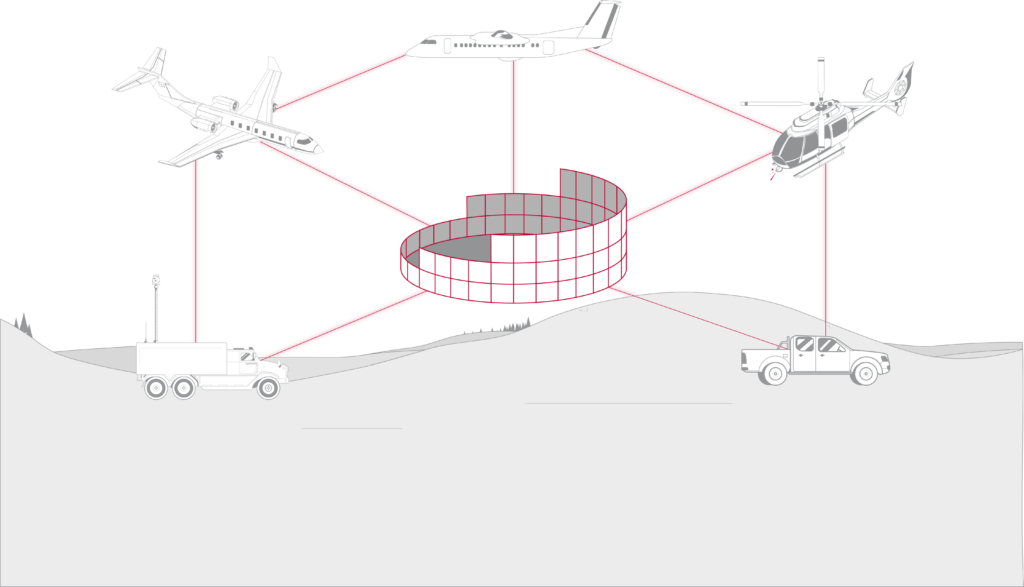

For alliances like NATO, evolving global security needs have shifted focus away from territorial defense to multinational expeditionary missions2, introducing a need for greater information sharing and the standardization of philosophies and technologies between nations.

To address ISR differences between member countries, NATO implemented the Joint Intelligence, Surveillance, and Reconnaissance (JISR) concept to align and combine the collection, processing, and exploitation of ISR information, supporting humanitarian, peacekeeping, and combat operations. JISR supports the foundation of a single architecture within which imagery and signals intelligence are standardized to provide interoperability between diverse systems.

Ground Surveillance

NATO implemented its Alliance Ground Surveillance system (AGS) in 2012 using remotely piloted systems to provide persistent situational awareness over large areas in any light or weather conditions using advanced radar sensors. The system collects data before, during, and after NATO deployment to detect changes, developing situations, and patterns of life, providing early warnings of potential threats to national territories.

However, with developments in science and technology, NATO has implemented a new program called Allied Future Surveillance and Control (AFSC) to develop a distributed network of ISR systems. AFSC dovetails with interoperable national airborne surveillance systems provided by NATO countries to comprise a comprehensive network of crewed and uncrewed assets to enhance surveillance capability.

Comments from industry experts suggest that the proliferation of low-cost multi-domain multi-mode airborne surveillance offers military alliances an opportunity to move away from their reliance on expensive strategic assets like the AWACS force. Stan Hargreaves, Head of Operational Capability Demonstrations at Italian multinational Leonardo Electronics, surmises that alliances may seek to “introduce less expensive and more capable tactical assets contributing to a central picture.” He believes that “more assets contributing makes each less vulnerable and the whole network more resilient.”

Scott Hillman is the Senior Director of Growth & Marketing for Utah-based IMSAR, a developer of high-performance multi-mode radar systems. Hillman agrees that some industry growth is currently due to the military’s need to bridge legacy ISR fleets with future technology. He says, “It’s fine if you want to have your large radars. You’ll maybe have a few of them, and they can cover wide areas, but there are easier, affordable ways to do that on different platforms that are smaller and lower cost to operate.”

Technology Convergence

Hargreaves suggests that these technological developments are the principal drivers of the growth in demand for airborne surveillance. He states that end-users require immediacy of information to enable actionable situational awareness, and a key enabler of that is airborne surveillance. The advent of state-of-the-art sensors, and better, more robust data links with greater bandwidth has massively increased the quality and distribution of information collected from airborne ISR platforms. With the introduction of cheaper, hugely capable, manned, and unmanned tactical platforms, the actionable ISR picture is becoming increasingly available globally. Intelligence surveillance and reconnaissance capability contribute directly to situational awareness in real-time across all domains. So it can go across the military domain and the information super highway to the media.”

Scott Hillman agrees with Hargreave but emphasizes that you have to speak a common language across your intelligence networks, saying, “interoperability is key to making all of these different technologies fit into situational awareness tools, so the operator that is on the large plane with the large, powerful legacy radar that can look hundreds of miles can also understand the picture that’s coming from the more widely distributed and smaller platforms throughout that space.”

Laurent Viala, a Product Manager at the French multinational company Thales, believes interoperability offers more than increased situational awareness for one operator. He asserts that “a high level of connectivity is an enabler of collaborative combat, with all platforms linked, supplying the same surface and air picture across all platforms.” Viala feels “Collaborative combat is the combat of the future.”

Hillman believes these distributed platforms sound the death knell for proprietary systems, stating, “The days of standalone proprietary systems are all but over. You’ve got to build things with open systems and architecture to be interoperable with the other technologies out there.”

Download Printable PDF

Download the PDF version for printing and sharing.

AIRBORNE SURVEILLANCE MARKET UPDATE

In 2020, analysts calculated the compound annual growth rate (CAGR) of the global airborne surveillance market was 2.2% 4. The growth between 2021 and 2028 is estimated at 6 to 8% CAGR, with the market value exceeding USD$ 7.5 billion by 2028 4.5. Marion Koch is the Head of Airborne & Space Radar Business Units for the German-headquartered Hensoldt Group, a leading manufacturer of sensors for defense and security applications and the PrecISR airborne multi-mission ISR radar. Koch cites the alignment of two global developments as driving market growth. She states, “We have the geopolitical situation worldwide and all the territorial conflicts like China, Taiwan, Russia, Greece, and Turkey. We also face a lot of terrorist activities at the borders and a huge wave of migrants with activities to detect refugee boats. Meanwhile, drug trafficking remains an issue worldwide”.

Koch continues, “In tandem, we’ve seen a huge technological step forward in airborne radar compared to other solutions. We have cheaper, more mobile solutions; with customers saying that radar has improved so much, they need to discuss if radar’s performance and opportunities have overtaken optical sensors as a solution”.

Radar systems comprised 32% of the global airborne surveillance market share in 2020.

Industry experts consider that figure will grow given the increasing use of radar surveillance by NATO and other defense, military, and security applications. Aside from NATO initiatives, illegal immigration, border disputes, and national defense initiatives fuel expenditure in the subsector of coastal surveillance radar. That ‘blue light’ market is forecast to grow from just under USD$ 1 billion in 2021 to USD$ 1.4 billion by 2028 at a CAGR of 5.7%.

Bettina Weber leads the Hensoldt sales team for airborne multi-mission radars. Weber notes, “Hensoldt has noticed a high demand for airborne radars, notably from customers with specific needs. They are flying with aircraft fleets approaching 40 years old. They need to get new aircraft with the latest technology on the market, realizing that the technology gap is huge. There is a huge difference between what can be performed with radar today and what could be performed decades ago.”

Scott Hillman believes that some of the projected market growth in the airborne surveillance market stems from a shift in strategic intent, which affects the tactical application of ISR and airborne radar. Hillman states, “The need for persistent stare during counterinsurgency and counter-terror operations initially drove the market growth of ISR. However, increased global tensions are driving us back to peer and near-peer adversary situations, reminiscent of the Cold War, with the need to monitor vast areas and ocean borders.”

The challenge is to take the suite of ISR tools developed for a different application and transfer those into a modern battlefield. Hillman says, “It’s absolutely necessary to solve that problem, which comes with lots of technological challenges and different ways of doing things. That’s what I feel is driving growth”.

Viala notes that some of the projected growth results from the flow-on of military ISR and airborne radar capability into the commercial sphere. He states, “We now have private ISR companies, search and rescue applications, and many missions using radar ground modes to identify fires or to track iceberg drift.”

Will Taylor is a Sensor Operator Supervisor with PAL Aerospace, a Newfoundland-based aerospace and defense company. Like Viala, he believes a contributor to growth is taking place in the commercial market due to the increased functionality of airborne radar. “I’m seeing a new development stream as independent designers respond to the commercial need. Airborne radar has become an imaging sensor in its own right. The resolution on them is so good that I’ve seen high-frequency high-resolution imagery that looks like low-resolution video, and you can see tractors moving up and down plowing fields. That’s incredible because you can do that in all weather and light conditions.”

END-USERS REQUIRE IMMEDIACY OF INFORMATION TO ENABLE ACTIONABLE SITUATIONAL AWARENESS, AND A KEY ENABLER TO THAT IS AIRBORNE SURVEILLANCE. THE ADVENT OF STATE-OF-THE-ART SENSORS, AND BETTER, MORE ROBUST DATA LINKS WITH GREATER BANDWIDTH HAS MASSIVELY INCREASED THE QUALITY AND DISTRIBUTION OF INFORMATION COLLECTED FROM AIRBORNE ISR PLATFORMS. WITH THE INTRODUCTION OF CHEAPER, HUGELY CAPABLE, MANNED, AND UNMANNED TACTICAL PLATFORMS, THE ACTIONABLE ISR PICTURE IS BECOMING INCREASINGLY AVAILABLE GLOBALLY

– Stan Hargreaves, Head of Operational Capability Demonstrations, Leonardo

CURRENT TRENDS IN AIRBORNE RADAR SURVEILLANCE

Current radar functionality seeks more reliable object detection, greater spatial resolutions, improved identification, and more persistent airborne ISR.

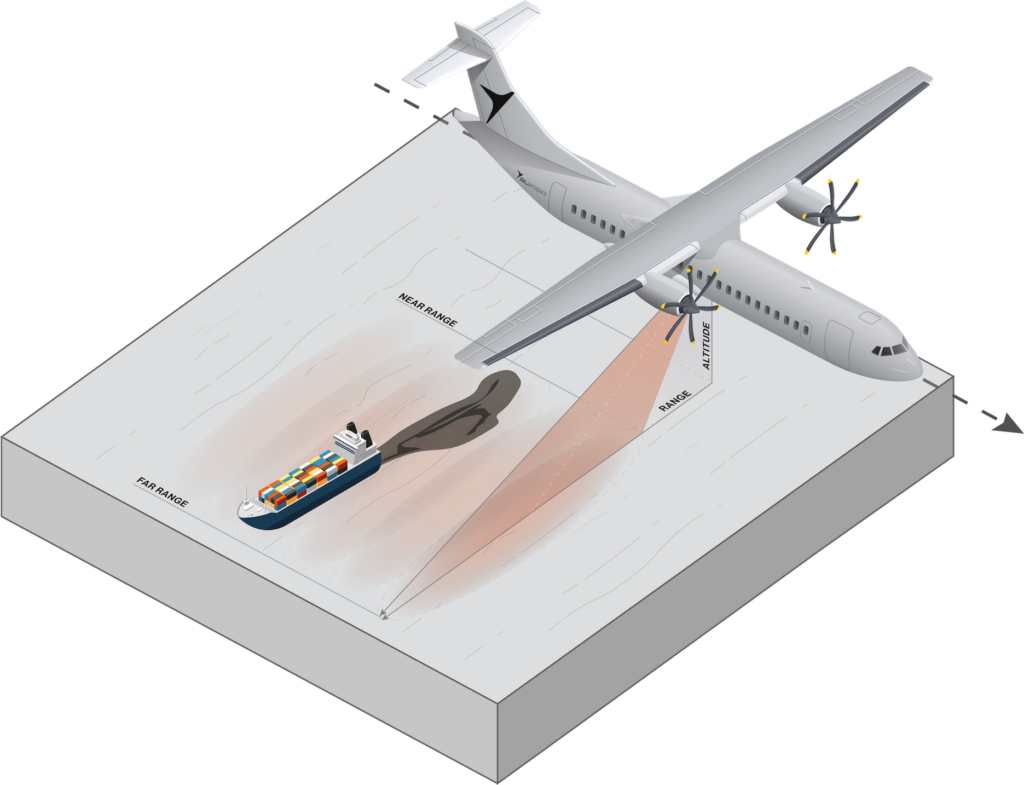

Side-Looking Airborne Radar

Side-looking airborne radar (SLAR) uses microwaves to produce high-resolution images of objects and terrain. The microwaves are transmitted from the side of the aircraft to create two or three-dimensional images of objects in a strip to either side of the aircraft’s track (strip mapping). The original SLAR systems used a real aperture antenna, yet synthetic aperture radar can now operate in an advanced SLAR role.

Radars used for identification and mapping are generally side-looking to distinguish multiple targets from each other. In contrast, a down-looking radar could not distinguish between two objects equally distant from the antenna. AESA radar can also direct a focused radar beam to a target of interest for higher-resolution imagery. This focused imaging is known as spotlight SAR. During ISR missions, data collection may take place using strip mapping to scan a large terrain area and then switch to spotlight SAR to analyze smaller areas for higher-resolution images.

Foliage Penetrating Radar

Optical imaging and microwave radar cannot reliably detect manufactured objects like vehicles, buried landmines, or unexploded ordinance (UXO) hidden beneath dense foliage; therefore, research into improved methodology has been underway since the 1990s. The key deliverable of foliage penetration (FOPEN) technology is high-resolution imagery to enable object identification and better separate the object from the background clutter.

The realization of three technologies, synthetic aperture radar (SAR), ultra-wideband (UWB) waveforms, and the polarization of a pulsed radar signal, has enabled high-resolution imaging through single and double-canopy forests using UHF and VHF frequencies. Research is ongoing to improve the current multi-mode ultra-wideband radar that provides SAR, buried objects (GPEN), and persistent moving target indication (MTI) under dense foliage. Work is also proceeding on automated 3-D change detection to better deal with the data-intensive post-collection analysis.

Scott Hillman cautions that such new technologies being available doesn’t mean they’re immediately deployable. While IMSAR has been involved in radar development to perform foliage or ground penetration, Hillman points out that “they’re highly customized sensors that require tuning on the ground, on location, to really be effective.” He feels that for the next three to five years, “It’s probably not going to be one-size-fits-all, and the systems will require quite a bit of tuning. You’re solving a complicated problem of getting radar energy down through a foliage canopy or different surface compositions with different moisture content.”

Kosmas Weidmann is Chief Engineer for Hensoldt’s PrecISR airborne multi-mission ISR radar product. He also has reservations regarding FOPEN development, citing two issues. He says, “This technology has been around for 20 years, using deeper frequencies on biomass and finding buried mines. However, financing this work requires an official demand, so is there a market for these extra functions?”

Weidmann continues, “And then you have to imagine it’s almost impossible to get an allowance in frequency. If you are in a war, you don’t ask for an official license if you are in a war. But can you imagine in peacetime broadcasting across the frequencies for mobile phones? It’s hard to get approval to use such a low-band radar.”

Multi-Sensor Data Fusion

Evolving technology, threats, and mission complexity are driving the demand for improved situational awareness, target identification, and tactical prioritization during airborne ISR. Ongoing research is continually improving the fusion of optical and non-optical sensor output that is both complementary and reinforcing to provide multi-spectral ISR, reducing operator workload and allowing the drawing of inferences from the results.

However, Hargreaves cautions that true data fusion brings practical challenges, requiring considerable background information on the data to guarantee the reliability of the integrated intelligence. He distinguishes between data correlation and data fusion with an example of radar detection of a ship and an automatic identification system identifying a particular ship. “So automatically, you might correlate those two to be the same target, yet that could be dangerous because that might be incorrect. So the initial correlation of two bits of information is quite straightforward, and everything points to the fact that it is probably the same target. However, it is more difficult to fuse the two elements to guarantee it is the same target. To fuse it, you’ve got to get more intelligence to be certain.”

The challenges of multi-sensor data fusion move beyond engineering design and verification issues to include the ever-increasing data complexity faced by sensor operators. PAL Aerospace’s Taylor believes the operator role to be rapidly evolving because of a modern system’s increased automation, complexity, and efficiency. “The algorithm is more efficient than a human, so at some point, perhaps we humans have to stop doing some of these processes and confine our decisions to where in the electromagnetic spectrum we’re looking, what we’re looking for, and why. In that scenario, an operator will become more like a systems analyst.”

However, Taylor emphasizes that if humans are going to be part of the decision-making chain, a greater design and development focus on data presentation is required. “Some operators are now almost untrainable due to data saturation. A human can think about one thing at a time and needs to be able to relate one thing to another easily and quickly. Technology integration is one thing, but we need more focus on data presentation to allow humans to manipulate it.”

The combination of networked systems, artificial intelligence (AI), and machine learning (ML) may provide the key. AI & ML can remove plot clutter from spurious tracks to reduce complexity. It can draw operator attention to critical targets while enhancing target tracking and identification. Through networking, multiple independent aerial platforms can integrate their outputs into one live 360-degree view of the local operating picture and stream to land, sea, or air-based operators.

Artificial Intelligence and Machine Learning

Thales’ Viala believes AI and ML technologies will be central to the evolution of ISR and airborne radar technology with increased complexity requiring a greater speed of response due to data fusion. He notes two core applications. “Radar central will become more and more complex in the future. So you need to help the operator. The operator behind the radar on combat or military missions will not be an engineer. So we need to help that operator identify what kind of target it is; what kind of truck, and artificial intelligence contributes to this operator assistance.”

Viala says the other application is sensor performance and radar autonomy. “I think future airborne radar will be software-defined. It allows the rapid adaptation of your sensor using different modes for different threats, permitting radar autonomy for increased performance. That’s the future. Quick and automatic configurations of settings and special modes to rapidly adapt to external conditions. For example, if you have increasing sea states, you need the radar’s specific modes to adapt. It’s not the same detection mode for sea-state two versus sea-state four.”

Hensoldt’s Marion Koch agrees that self-learning software is the future. She says, “We’re putting in different sensors and training the software to distinguish which sensor is best for a given problem. Then we’re going further, with the software deciding what next to target and who can best resolve a specific situation.”

Ongoing Reductions in Size, Weight, Power, and Cost

Thirty years ago, a Boeing 707 was required to house the radar system used by the US to monitor the Iraqi invasion of Kuwait. Today, improved manufacturing methods produce systems with greatly reduced size, weight, and power/cost (SWaP-C). A comparable synthetic aperture radar system capable of ground moving-target indication (GMTI) is routinely used on uninhabited aerial vehicles (UAVs) of just over 8 feet. However, miniaturization continues with modern radar modules weighing just 7.4 pounds installed on drones 5 feet long, requiring only an ethernet connection and power. They can fly at 16,000 feet and loiter for more than 24 hours, collecting data.

While Scott Hillman feels further size reductions are possible, he notes, “When you go smaller from where we are now, it’s almost not meeting the performance specs on anything. So you get into that realm of, okay, I can do it from this platform, but is it useful at that point if my range or available bandwidth is limited? If I can’t get enough bandwidth to the ground, I can’t get adequate resolution from the imagery to answer the question I need to answer on the ground.”

Will Taylor agrees with Hillman, stating that while the SWaP-C of a system continues to reduce, “the network bandwidth requirements are increasing exponentially. One of the biggest problems operators have using high-resolution modes is the ethernet backbone struggles to transmit the volume of data even within the aircraft. This bottleneck can make it difficult to transmit the information to the ground for real-time analysis. We can handle it for now, but that’s where the emphasis lies for further development.”

The answer to the size/power/bandwidth paradox may lie in distributed apertures which involve building a composite radar return from multiple miniature UAVs. Hillman agrees, “At a high level, yes, I think that’s where we’re heading. Distributed apertures are definitely of interest; using smaller and smaller unmanned systems and then creating mission autonomy within them; that’s your swarming technology. It’s beginning to be in the realm of possibility to be able to do that.”

AIRBORNE RADAR CONCLUSION

Airborne radar surveillance has entered a new era, driven by technological advancements and an evolving global security landscape. As operators face increasingly complex mission environments, the emphasis on flexibility, interoperability, and real-time intelligence sharing has never been greater. By leveraging modular, scalable solutions and integrating advanced radar systems with multi-sensor data fusion, operators can enhance situational awareness and operational effectiveness. As the need for faster, more adaptable, and collaborative systems grows, CarteNav offers radar-agnostic, multi-mission software that empowers organizations to meet today’s intelligence, surveillance, and reconnaissance challenges head-on.

Explore CarteNav’s featured radar integrations>> cartenav.com/systems/

Download Printable PDF

Download the PDF version for printing and sharing.